Helmsman Group

Sprint, Iterate, Thrive: How Agile CPG Leaders Can Grow Amid Market Turbulence

By Mark Haas | Food Science Innovator & Nutrition Research Expert | Helping brands balance nutrition science, culinary excellence, CPG Product Development and market viability

When the pandemic struck in early 2020,

the CPG product development landscape transformed overnight. Some executives adapted with remarkable agility, while others faltered under pressure. Years later, uncertainty remains the only constant, now shaped by inflation, geopolitical tensions and cautious consumer spending.

For mid-market CPG leaders today, the challenges feel eerily familiar. Retail buyers from Whole Foods to Costco demand exceptional value at competitive prices. Once reliable suppliers have become potential liabilities as tariffs, inflation and political uncertainty strain traditional sourcing strategies, particularly from Asia.

Yet amid these headwinds, agile companies are discovering hidden opportunities. The path forward requires embracing a startup mindset: rapid iteration, careful experimentation, data-driven CPG product development and decisive action. These approaches often feel uncomfortable for organizations accustomed to longer planning cycles.

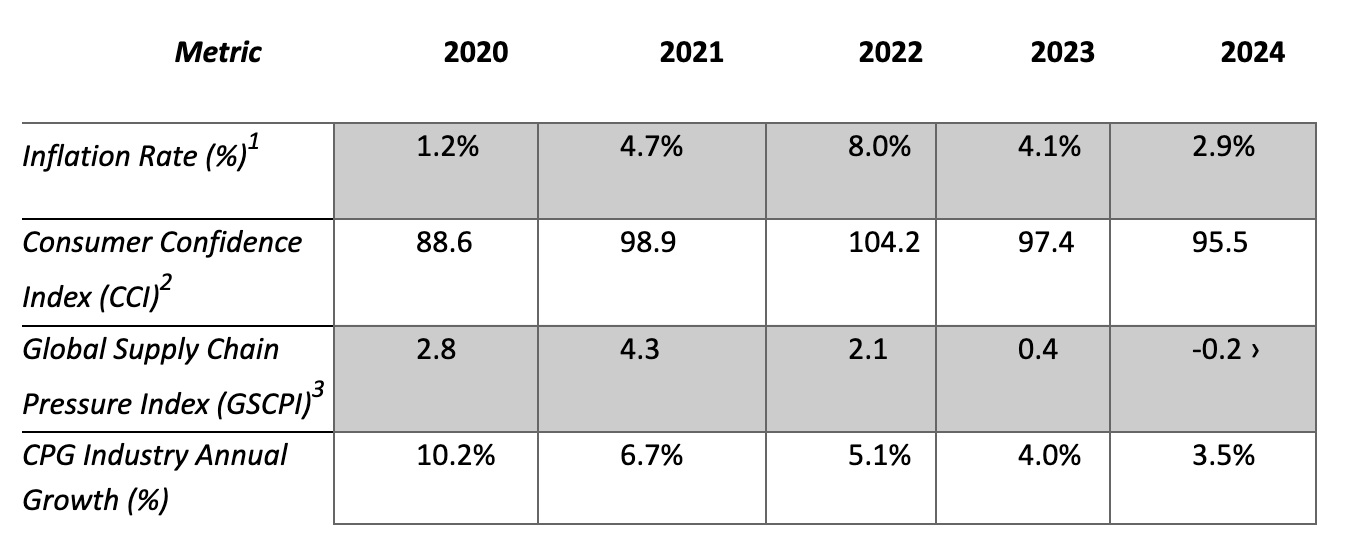

Pandemic-era and Post-pandemic CPG Market Data (2020–2024):

1. U.S. Bureau of Labor Statistics (BLS) & Statista

2. The Conference Board

3. Federal Reserve Bank of New York,

Note: there is a lag of several months in the GSPCI – I predict 2020-2021 era supply chain disruptions – at least

Consider this revealing case study from the pandemic era: Two mid-sized snack brands faced identical supply chain disruptions. The first clung rigidly to established practices, resulting in persistent stockouts, rising costs and eroding consumer trust. The second pivoted swiftly to simplified production, focusing on comfort driven products that resonated deeply with anxious consumers. By streamlining their supply chain and reducing complexities, they achieved unprecedented demand and margins, not just surviving but thriving during turbulence.

The lesson? While solutions seem obvious in retrospect, it’s precisely these moments of uncertainty that offer opportunities for decisive action. Today, we face similar circumstances with different variables but familiar strategic choices. Those who proactively adapt will find openings where others see only obstacles.

Recognizing Reality: The New Normal in CPG

For mid-market executives, uncertainty isn’t a temporary disruption; it’s the new operating environment. Supply-chain volatility, rising costs and evolving consumer behaviors have become persistent challenges rather than passing storms. Retailers have grown increasingly cautious, favoring products that reliably deliver proven value, while competition for limited shelf space has intensified.

Sourcing strategies heavily dependent on international markets face continued strain from political instability and tariff pressures. These challenges underscore the necessity of developing robust, agile supply chains capable of quickly adapting to changing conditions. Brands must prioritize flexibility, cost effective innovation and transparent consumer communication to remain competitive.

Opportunities in Disguise: Emerging Market Trends

Even in uncertainty, certain market segments continue to flourish. Our research indicates that consumers consistently seek products blending quality and comfort during challenging times.

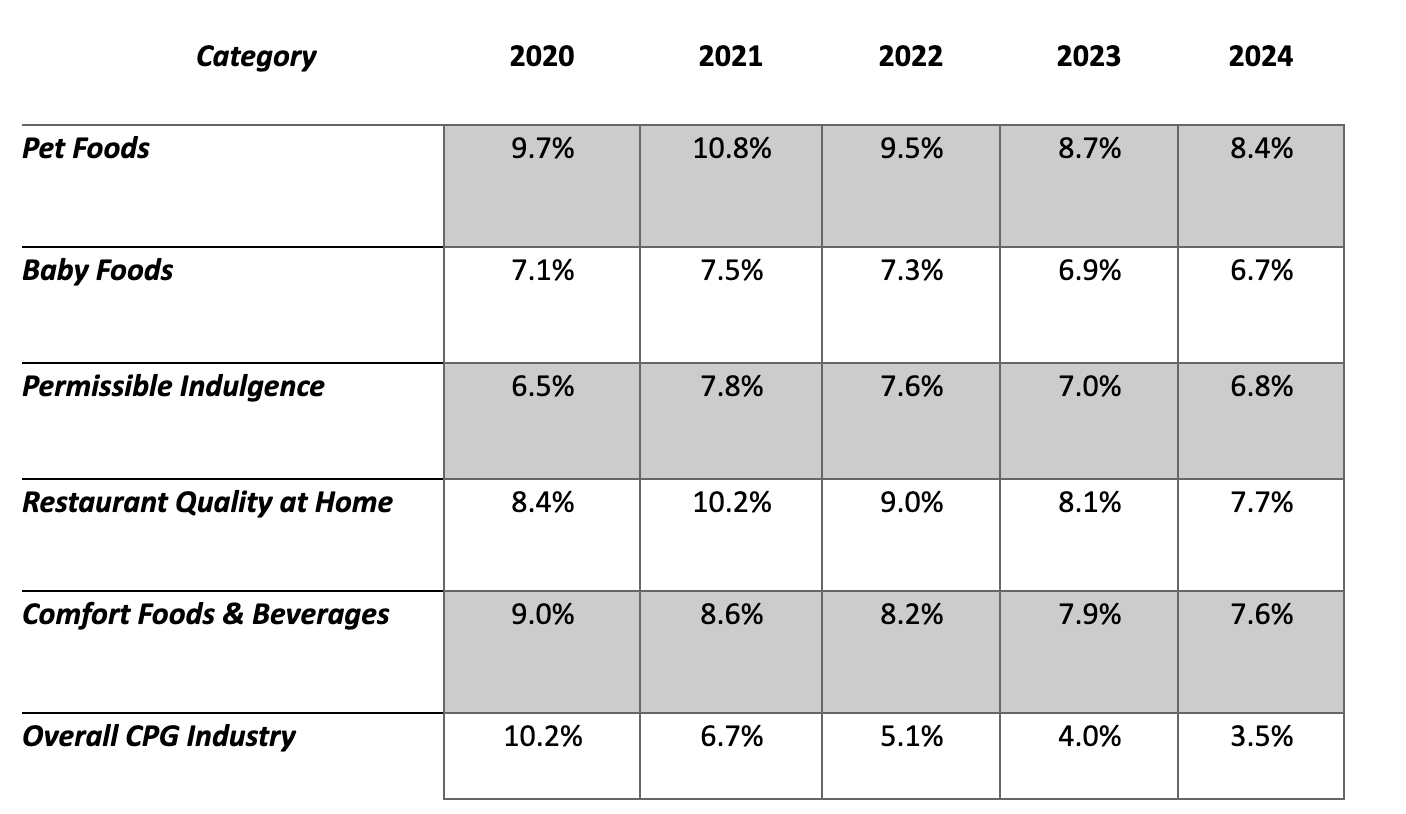

Five categories show particular resilience:

Pet Foods: Consumers prioritize their pets’ wellbeing even when tightening their own belts, sustaining demand for premium pet products (NielsenIQ).

Baby Foods: Parents consistently emphasize nutritional quality and safety, maintaining steady demand despite economic constraints (Straits Research).

Permissible Indulgence: Affordable luxury items providing emotional comfort without excessive cost continue gaining popularity, with 76% of consumers preferring indulgent snacks regardless of calories (Bakery and Snacks).

Restaurant Quality Foods at Home: With cautious spending, consumers increasingly desire premium culinary experiences without dining out, driving demand for chef inspired meal solutions (Innova Market Insights).

Comfort Foods and Beverages: Economic uncertainty fuels demand for comforting, nostalgic products offering emotional solace through what’s been termed the “Comfortcore” trend (Better Homes & Gardens).

Category Growth Rates vs. Overall CPG Industry Growth (2020–2024)

Understanding and strategically leveraging these enduring consumer trends can significantly benefit mid-market brands. Data validation from these trusted industry sources confirms these aren’t merely observations but documented patterns executives can confidently build strategies around. Those who respond proactively to these validated preferences position their companies for sustained growth, even in turbulent markets.

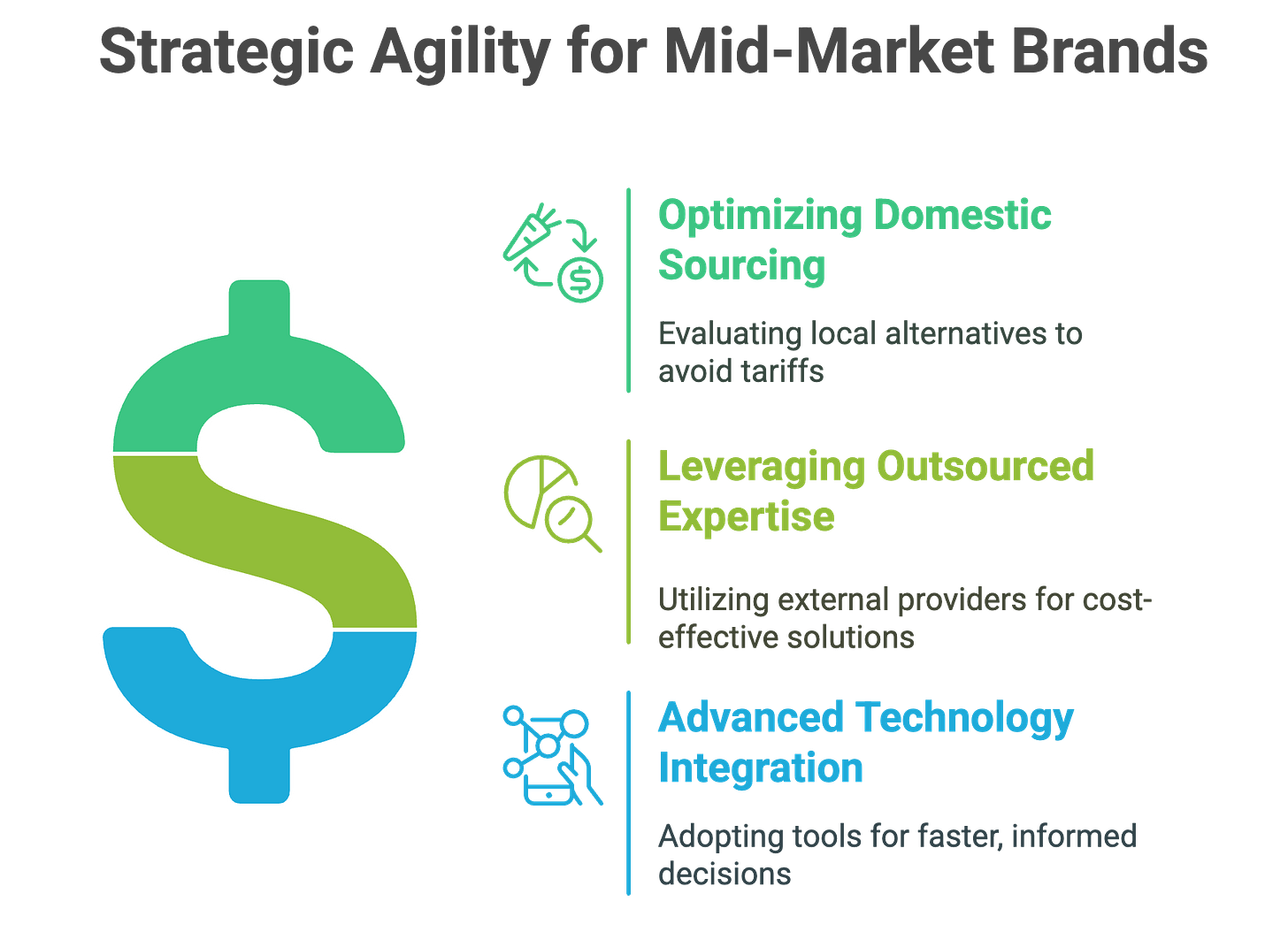

Agile Innovation: Doing More with Less

Optimizing Domestic Ingredient Sourcing: Evaluate potential domestic alternatives for imported ingredients to avoid tariff induced cost increases. Remember that during shortages, suppliers typically prioritize existing relationships, making proactive supplier relationship building essential.

Leveraging Outsourced Expertise: Outsourced specialized service providers remain largely unaffected by tariffs, providing cost effective, scalable solutions to operational and administrative tasks.

Advanced Technology Integration: Accelerate adoption of automated analytics and forecasting tools to enable faster, more informed decisions, critical for maintaining momentum with constrained resources.

Success in navigating austerity while achieving growth ultimately hinges on prioritizing human relationships with key suppliers while simultaneously deploying advanced technologies. This balanced approach ensures your company remains competitive while enabling your existing team to effectively manage increased workloads despite staffing constraints.

Why Speed Matters: Iterate Quickly and Move in Sprints

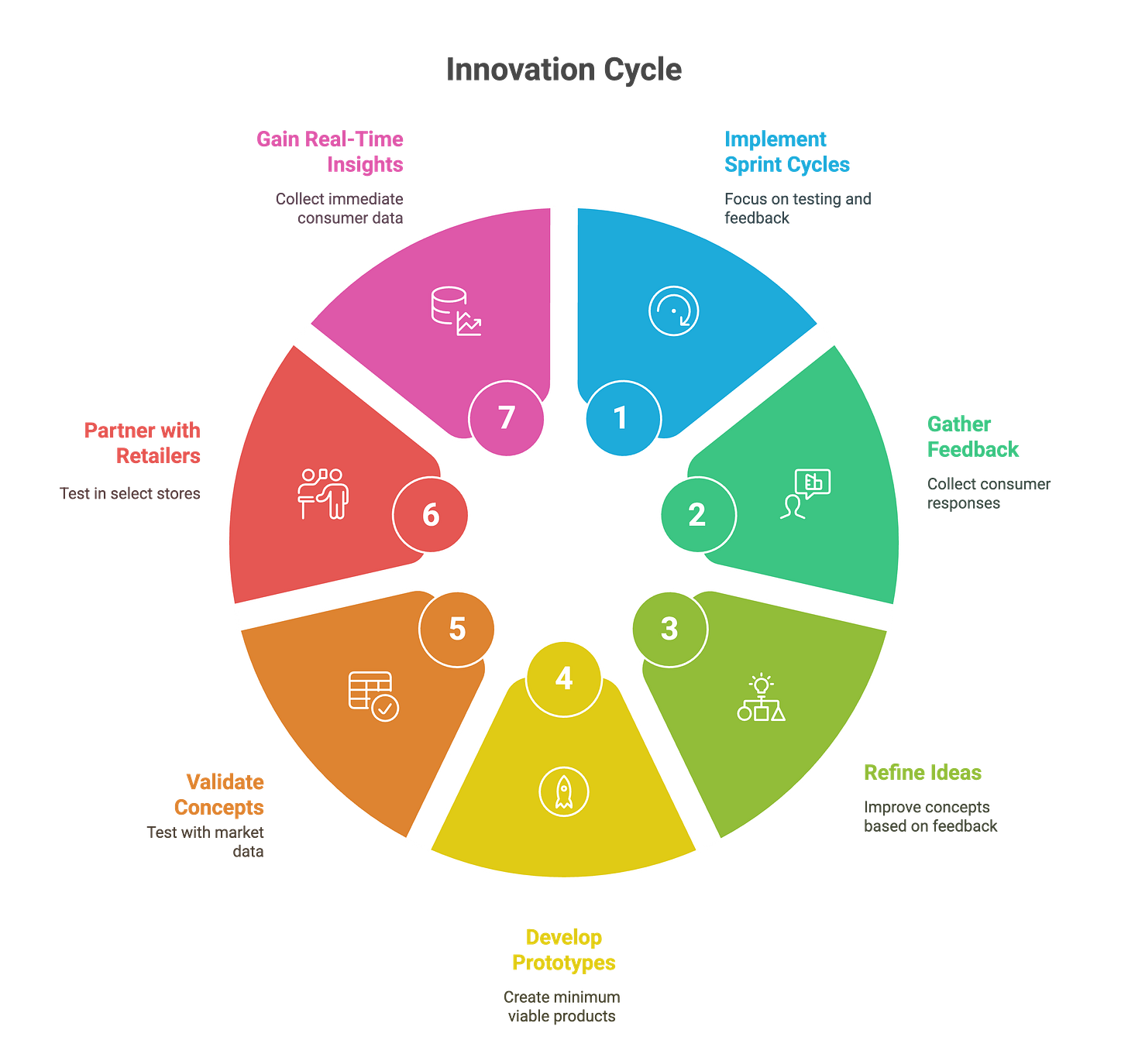

In uncertain economic climates, mid-market CPG brands can gain significant advantages by embracing lean startup methodologies. Short, iterative innovation cycles allow executives to quickly test concepts, adapt to feedback and minimize financial risk.

The approach is refreshingly straightforward: place your product in a manageable number of stores for at least six weeks to test everything from branding and claims to formulations and price points. This scrappy, entrepreneurial method ensures direct, actionable insights without massive investment.

Consider how brands like Poppi have leveraged this approach, rocketing from startup status to household recognition. Their success demonstrates how an iterative, test and learn approach can significantly shorten your scaling curve by months or even years, delivering dividends through focused execution and rapid adaptation.

Key practices include:

Sprint Cycles: Implement focused 6-12 week periods dedicated to testing, gathering feedback and refining ideas based on consumer responses.

Rapid Prototyping: Quickly develop minimum viable products to validate concepts with real market data.

Transactional Learning: Partner with loyal retailers to test new concepts in select stores, providing real time consumer insights.

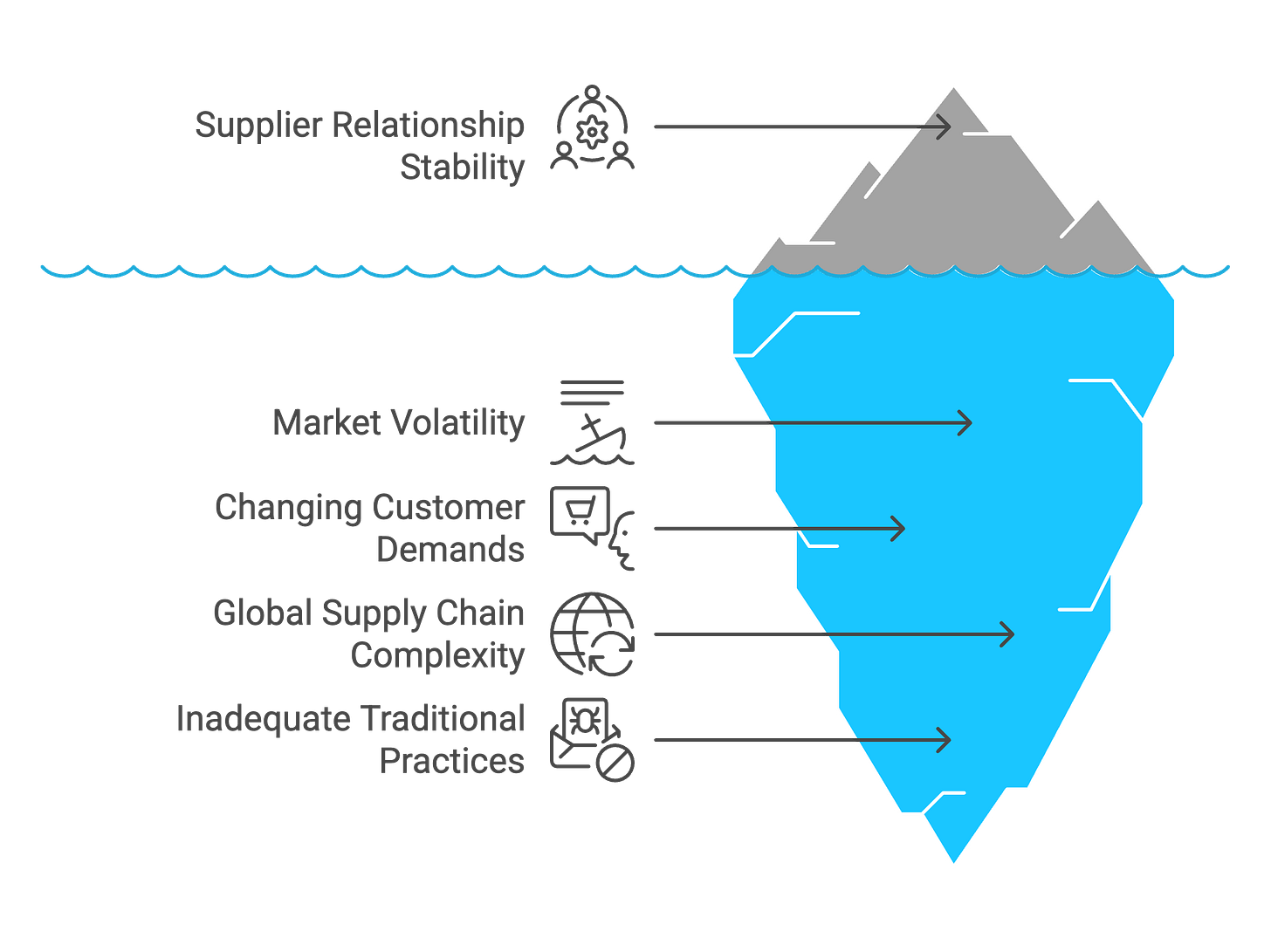

Navigating Supplier Relationships: Finding Stability Amid Change

The current geopolitical climate is dramatically reshaping supply-chain dynamics across North America. Canadian retailers are increasingly moving away from U.S. based manufacturing partners, forming new alliances with nearshore facilities in Mexico, potentially evolving into enduring partnerships if proven beneficial.

This shifting landscape in CPG Product Development creates both risks and opportunities for mid-market CPG brands. Those aligned with U.S. contract manufacturers losing substantial Canadian business face significant vulnerability if those manufacturers experience financial distress. Conversely, brands capable of scaling up internal production could gain substantial competitive advantages in agility, quality control and cost management.

In today’s environment, traditional supplier management practices fall short. Executives need a more strategic framework for evaluations, focusing on factors directly impacting stability:

Customer Concentration: Avoid suppliers heavily dependent on one or two major clients.

Real Time Flexibility: Prioritize suppliers with demonstrated agility during past market disruptions.

Integrated Communication: Establish ongoing, clear communication channels about inventory status and risks.

Established Capacity: Partner with suppliers having proven scalability, rather than promises of future growth.

Historical Consistency: Choose suppliers with documented records of meeting deadlines and maintaining quality.

Mutual Strategic Goals: Ensure your suppliers’ long term objectives align with your company’s direction.

Taking these strategic steps now will position your company to effectively manage risks and maintain competitive strength, even amid continued market uncertainty.

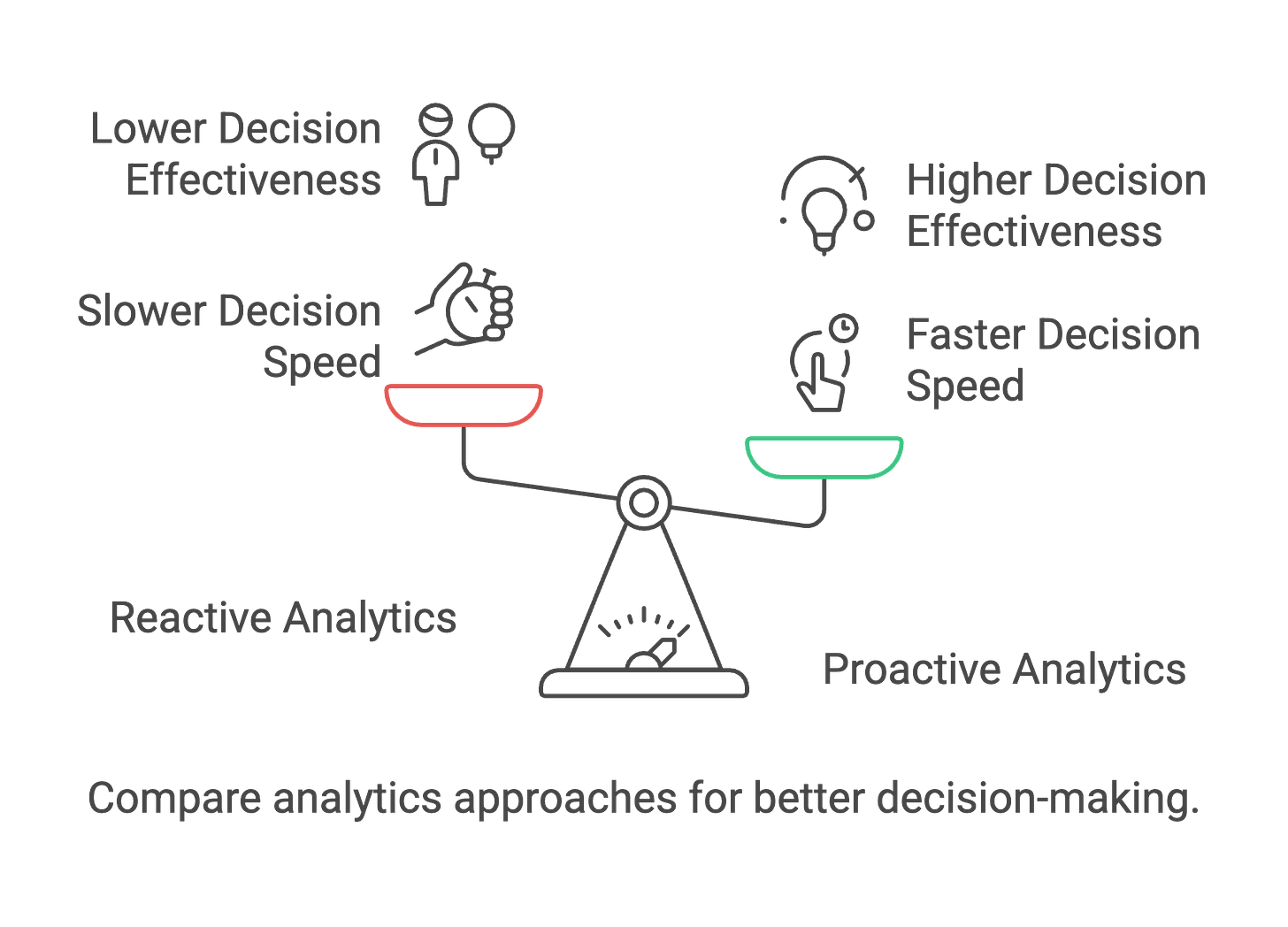

Strategic Agility: Leveraging Data Driven Decision Making

Most executives claim to use data for decisions, but many only use metrics to justify choices already made, or worse, rely on gut instincts wrapped in a veneer of analytics. In today’s CPG landscape, this approach invites mediocrity, if not failure

To genuinely compete, you must harness analytics in real time, embedding data driven insight directly into daily decision-making. Too often, mid-market companies fail at this practice, either overwhelmed by complexity or skeptical of the value, while their more disciplined competitors quietly capture market share.

Imagine a radically different scenario: Your analytics platform flags potential price spikes immediately, triggering scenario-based forecasts across your supply chain and product portfolio. Rather than deliberating after crisis hits, you convene proactively with precise predictive models and clear contingency options. You swiftly secure alternative sourcing, optimize inventory, adjust pricing strategies and pivot marketing, all within days, not weeks. While competitors struggle to react, you move decisively, protecting margins and capturing opportunities others never saw coming.

This isn’t about generating more reports; it’s about changing your company’s decision-making DNA. Successful executives make analytics an everyday leadership discipline, pushing teams to ask better questions, test assumptions rapidly and make informed adjustments swiftly. This proactive approach transforms uncertainty into opportunity in CPG Product Development.

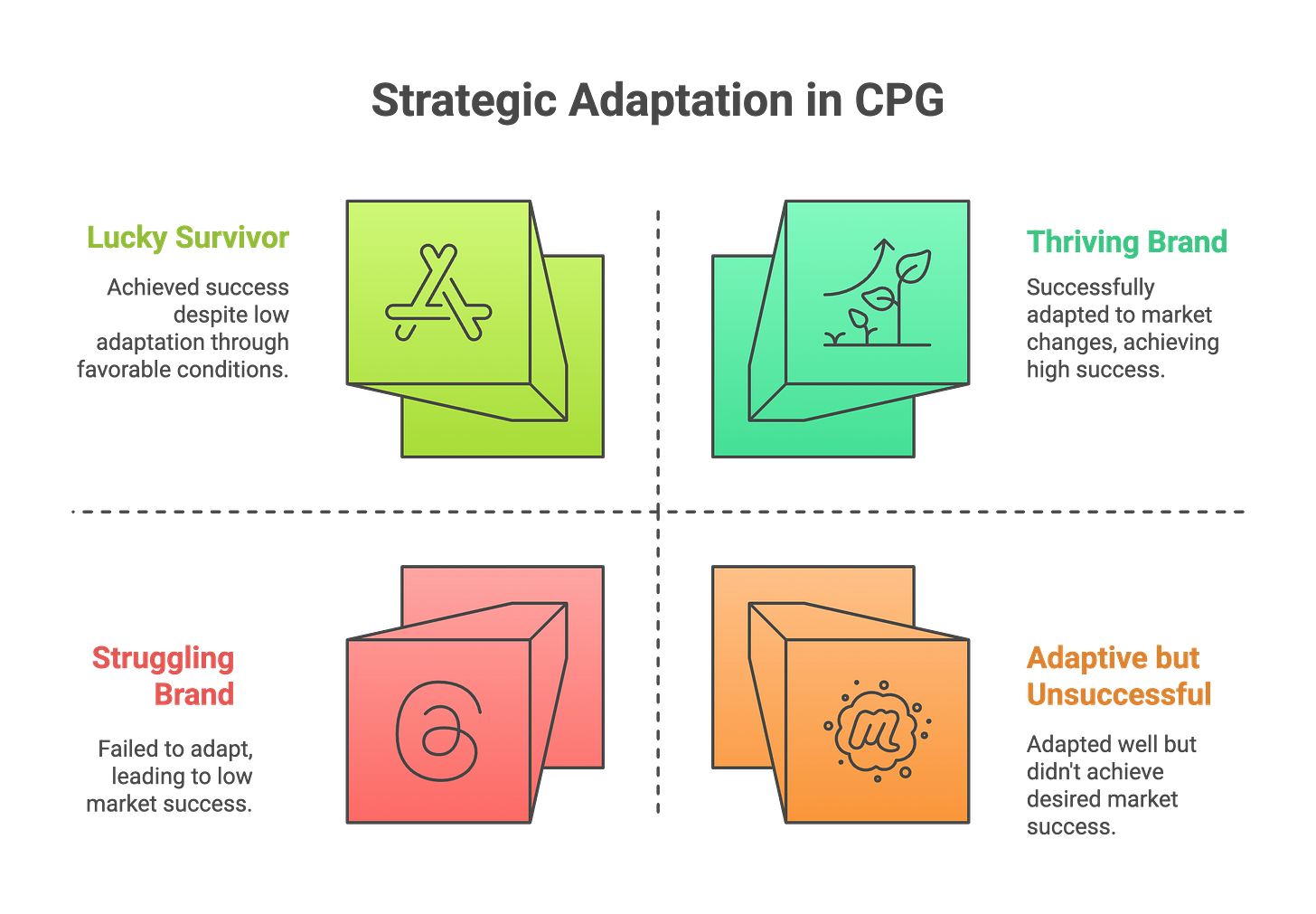

Turning Turbulence into Competitive Advantage

The CPG Product Development market won’t wait, and neither can you. These strategies aren’t merely options; they’re imperatives. In a world where disruption is the new normal, success no longer depends on scale or past performance, but on your organization’s willingness to adapt, iterate and execute decisively.

Whether aggressively validating innovations through transactional learning, strengthening supplier partnerships before disruption hits or embedding predictive analytics within your decision-making processes, the choices you make now will define your market position for years to come.

There is no status quo, only forward momentum or gradual decline. Embracing uncertainty as a catalyst for transformation positions your brand not just to survive coming storms, but to outpace competitors and emerge stronger.

This is your moment to take control, innovate with purpose and move with strategic clarity. Agile leadership isn’t simply an advantage; it’s now the defining factor separating thriving brands from those left behind.

The future belongs to those who act boldly today.

Check out this Article on: Substack

About the Author: Mark Haas is CEO of The Helmsman Group, specializing in helping mid-market CPG brands navigate market turbulence through strategic agility and data-driven decision-making powered by InsightSuites™, their proprietary consumer intelligence platform.